** For claims submitted though a clearinghouse or MD On-Line, a copy of the transmission report and rejection report showing that the claim did not reject at the clearinghouse or at Tufts Health Plan (two separate reports). ** Copy of EOB as proof that the member or another carrier had been billed, if the member did not identify him/herself as a Tufts Medicare Preferred HMO member at the time of service.įor EDI claim submissions, the following are considered acceptable proof of timely submission: ** Copy of EOB from the primary insurer that shows timely submission from the date that carrier processed the claim. ** Copy of patient ledger that shows the date the claim was submitted to Tufts Health Plan. These should always be kept (in electronic format) on your computer by date in a folder that is regularly backed-up.įor paper claim submissions, the following are considered acceptable proof of timely submission: For electronic claims, you should have the claims submittal report from your clearinghouse. There is no reason to photocopy all claims just in case you need to prove timely filing.

UHC TIMELY FILING LIMIT SOFTWARE

Ask your software provider to walk you through reprinting a claim with the original date. The first thing that you will need is proof that you actually did file the claim within the time window allowed.įor paper claims, you can reprint and attach the original claim, however some billing software will put today’s date on the reprinted claim. You should and must now appeal the denial.

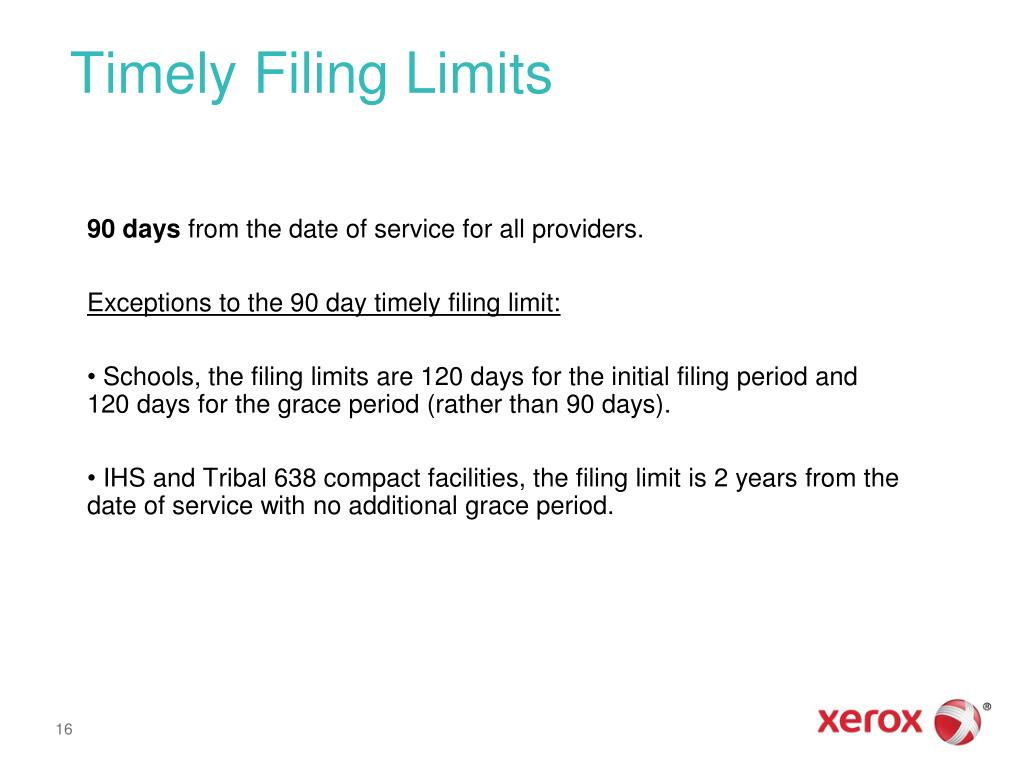

If it is outside their “timely filing”, you will get a denial back. Now your only recourse is to rebill the claim. When you call to follow up, they will state, “we have no record in our system of having received that claim.” A large insurance company may receive over 100,000 claims a day and their systems cannot hold that volume of pending claims. After that, if they are not paid or denied, they are deleted from their computers. If the claim has been submitted within the TFL period, call customer care and request for Reopening the claim'Ī frustrating problem when doing account follow-up is that most insurance companies only hold or “pend” claims in their system for 60 to 90 days. If DOS has been wrong, resubmit with correct DOS It is also poor consumer relations to make the patient pay for your office’s failure to submit the claim.Ĭheck whether it has been billed within TFL period (One year from DOS) If you actually were outside the timely filing limit, many insurance companies and most provider agreements prohibit you from pursuing the patient for the denied balance. Medicare and Medicaid have specific appeal guidelines in their provider manuals, but other insurance companies vary. In these cases, you can appeal the claims, but you must call the insurance company and see what their appeal rights are. The only exceptions might be when you are dealing with a Medicare secondary and were appealing a denial prior to submitting to the secondary, or when an account was sent to work comp, then after much review was denied as not liable and now must be billed to health insurance. There should seldom be a time when claims are filed outside the filing limit. If you are a contracted or in-network provider, such as for BC/BS or other insurance like UHC, Aetna, the timely filing limit can be much shorter as specified in your provider agreement. If you file them later than the allowed time, you will be denied.įor most major insurance companies, including Medicare and Medicaid, the filing limit is one year from the date of service.

UHC TIMELY FILING LIMIT CODE

Timely Filing Denial and Solution -Denial Code -CO 29 The time limit for filing has expired.Įvery insurance company has a time window in which you can submit claims.

0 kommentar(er)

0 kommentar(er)